Why Modern Businesses Need Credit Collection Software in 2025

Introduction: The Urgent Need for Smarter Debt Recovery

In today’s fast-paced business environment, managing outstanding receivables is more challenging than ever. With rising operational costs and increased competition, delayed payments can severely affect cash flow and profitability. Traditional methods of debt collection—manual follow-ups, spreadsheets, and phone calls—are no longer sufficient. In 2025, modern businesses must turn to credit collection software to automate recovery processes, improve customer engagement, and enhance financial performance.

The Shortcomings of Manual Collection Processes

Many businesses still rely on outdated, labor-intensive methods to track and collect unpaid invoices. This approach is not only time-consuming but also error-prone and inefficient.

Key challenges of manual collection include:

- Inconsistent follow-ups leading to prolonged recovery cycles

- Lack of centralized data, causing communication breakdowns

- Limited tracking of payment history and collector performance

- Poor customer experience, damaging long-term relationships

As businesses scale, these problems only grow—making manual processes unsustainable in the long run.

Benefits of Credit Collection Software in 2025

Credit collection software is specifically designed to streamline and automate the entire debt recovery lifecycle. In 2025, such platforms are smarter, faster, and more intuitive than ever before.

Top benefits include:

- Automated Follow-Ups: Schedule SMS, email, or call reminders to ensure timely payments without manual intervention.

- Real-Time Dashboards: Monitor outstanding amounts, track recovery performance, and view collector KPIs instantly.

- Improved Customer Communication: Maintain professional, personalized communication that improves repayment likelihood.

- Secure Data Handling: Ensure customer information is stored securely and complies with financial regulations.

- Integration with Finance Systems: Sync with your accounting tools to track invoices, payments, and disputes seamlessly.

Why Businesses Should Invest in Credit Collection Software Now

Waiting to adopt a modern debt recovery solution means lost revenue and missed opportunities. Businesses that embrace automation are seeing faster recovery rates, improved customer relationships, and more accurate financial forecasting.

Key reasons to invest in 2025:

- Rising volume of credit-based transactions in B2B and B2C sectors

- Increased regulatory scrutiny demanding more transparent practices

- Customer preference for digital engagement over manual calls

- Competitive pressure to maintain healthy cash flows and reduce DSO (Days Sales Outstanding)

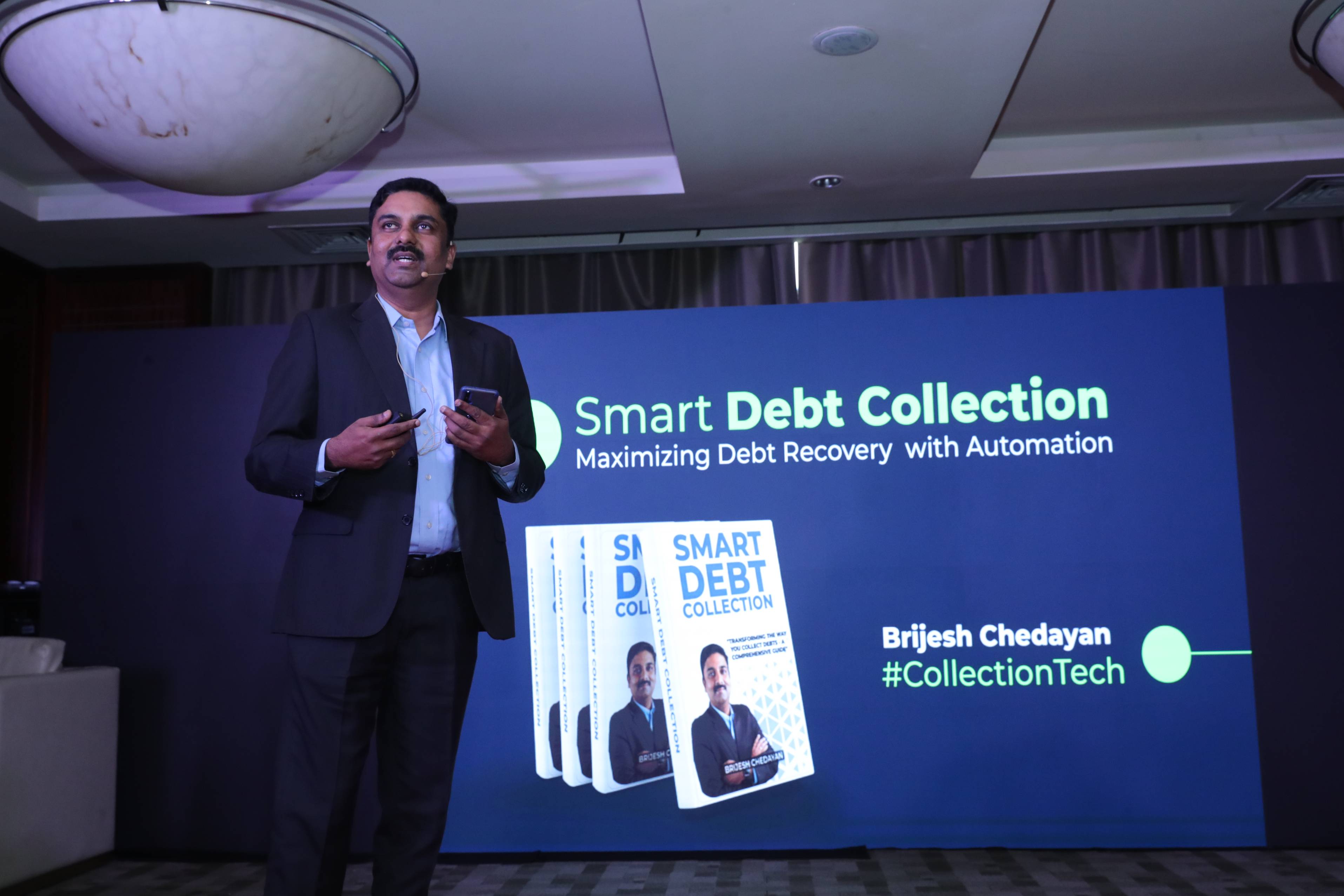

For Credit Collectors in Rwanda: Smart Debt Collection by Beveron

Credit collection professionals and agencies in Rwanda face unique challenges, from local regulatory compliance to managing multiple client accounts. Beveron’s Smart Debt Collection software is purpose-built to address these needs.

- Fully localized for the Rwandan financial environment

- Cloud-based platform accessible from anywhere

- Multichannel communication tools for automated follow-ups

- Smart analytics to track collections, predict trends, and optimize strategies

- Easy integration with existing CRM and ERP systems

Whether you're a credit agency or an in-house collections team, Beveron’s solution empowers you to collect smarter, faster, and more efficiently.

Future-Proof Your Collections Strategy

Credit recovery in 2025 demands more than persistence—it requires precision, technology, and smart automation. Credit collection software is no longer a luxury; it’s a necessity for businesses serious about sustaining cash flow and reducing risk.

Ready to transform your collection process?

Explore Beveron’s Smart Debt Collection—the leading solution for credit collectors in Rwanda—and take your recovery efforts to the next level.

Best credit collection software in Rwanda

Best debt collection software in Rwanda

Best debt recovery software in Rwanda

If you need free demo on best credit collection software in Rwanda, please fill the form below.