From Manual to Digital: Transforming Collections with Technology

Introduction: A New Era in Debt Collection

In an increasingly digital world, manual debt collection processes are becoming outdated, inefficient, and costly. Traditional methods—reliant on spreadsheets, phone calls, and physical files—are time-consuming and error-prone, leading to missed opportunities, compliance risks, and lower recovery rates. As customer expectations evolve and regulatory demands increase, credit collection agencies and finance departments must embrace technology-driven solutions to stay competitive. The shift from manual to digital collection isn’t just a trend—it’s a necessity.

The Limitations of Manual Collection Processes

Manual collection methods often lead to disorganization, delays, and inconsistent follow-ups. These inefficiencies impact cash flow and client satisfaction.

Common challenges include:

- Difficulty in tracking payment status and debtor communication

- Lack of centralized records and real-time data

- Inconsistent reminders and follow-up routines

- Increased chances of human error and compliance violations

Without the right tools, even the most skilled teams can fall behind in their recovery efforts.

How Technology is Revolutionizing Debt Collection

Modern debt collection software brings automation, transparency, and structure to the entire recovery process. It empowers collection teams to work smarter by digitizing workflows and enabling data-driven decision-making.

Key benefits of digital collection tools:

- Centralized client and debtor databases

- Automated reminders, follow-ups, and escalation workflows

- Real-time dashboards and performance analytics

- Integration with payment gateways and CRM systems

These features significantly improve collection rates and reduce turnaround times.

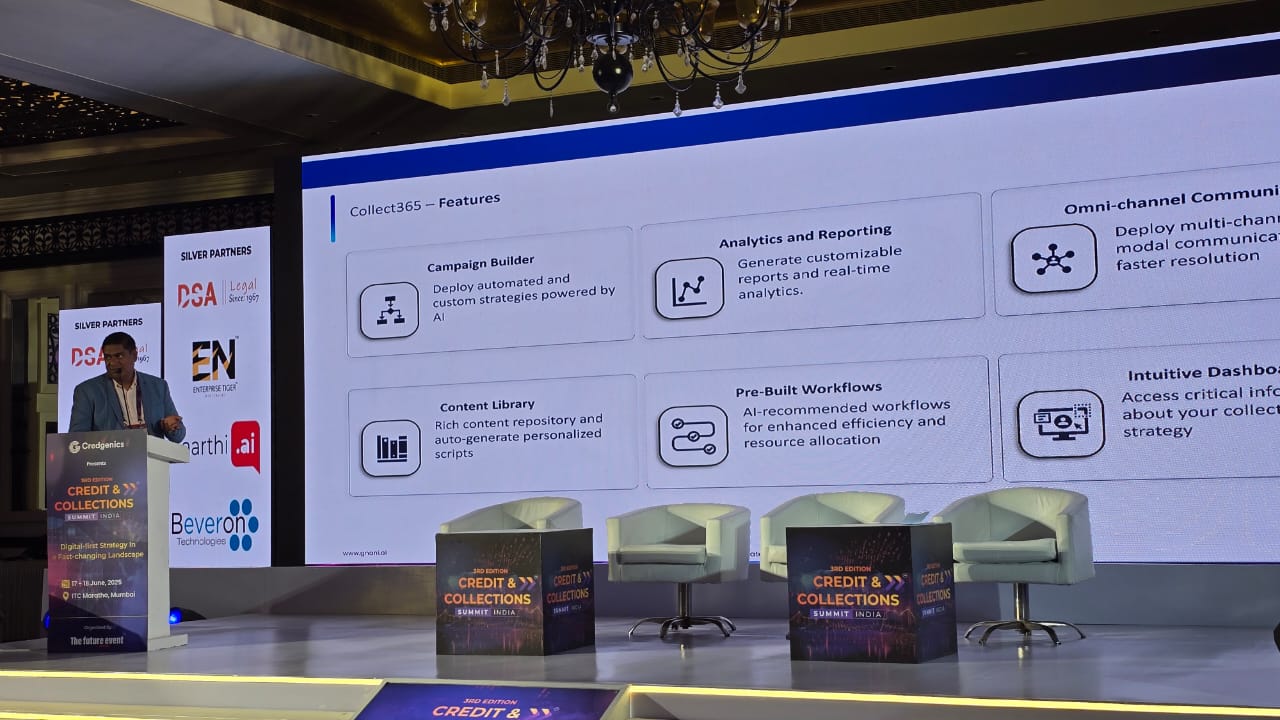

Core Features to Look for in Debt Collection Software

When transitioning to a digital platform, it’s crucial to choose software that offers both flexibility and power. The right solution should adapt to your workflows and enhance your team's productivity.

Must-have features include:

- Customizable collection stages and workflows

- Automated communication via email, SMS, and WhatsApp

- Real-time tracking of recovery status

- Secure document storage and compliance reporting

- Role-based access and audit trails for data integrity

Selecting a solution with these features ensures scalability and long-term efficiency.

The Business Impact of Digital Collections

Digital transformation doesn’t just streamline operations—it directly boosts the bottom line. Agencies and organizations that adopt digital debt collection tools see measurable improvements in:

- Collection efficiency and recovery rates

- Staff productivity and reduced manual workload

- Customer experience and satisfaction

- Compliance management and regulatory reporting

- Faster decision-making through actionable insights

Simply put, going digital allows collection teams to do more with less while driving better outcomes.

For Credit Collectors in India: Why Smart Debt Collection Leads the Way

For credit collection agencies and finance teams in India, Beveron’s Smart Debt Collection offers a purpose-built, cloud-based platform tailored to local business needs and compliance standards.

Why Smart Debt Collection stands out:

- Local language support and Indian financial ecosystem integration

- Automated workflows designed for Indian collection cycles

- Secure, cloud-based access with real-time case tracking

- Dashboard views for agents, managers, and clients

- Easy integration with CRMs, accounting tools, and payment systems

Trusted by leading agencies, Smart Debt Collection helps teams increase recovery rates while reducing costs and manual work.

Go Digital and Maximize Recovery

In today’s fast-paced financial world, clinging to manual processes is no longer sustainable. Embracing digital debt collection solutions is the key to achieving operational excellence, client satisfaction, and long-term success.

Ready to transform your collection strategy?

Start your digital journey with Beveron’s Smart Debt Collection—India’s most advanced and reliable collection management software.

Best credit collection software in India

Best debt recovery software in India

Best debt collection software in India

If you need free demo on best credit collection software in India, please fill the form below.