AI in Credit Collection: Smarter Strategies for Faster Recoveries

AI in Credit Collection: Smarter Strategies for Faster Recoveries

The debt collection industry is undergoing a major transformation, thanks to the power of Artificial Intelligence (AI). Traditional methods of credit recovery often involve manual processes, inconsistent communication, and time-consuming follow-ups. AI-powered credit collection software is changing that—bringing automation, precision, and speed to the forefront of debt recovery operations.

In this article, we explore how AI is reshaping credit collection and highlight the best strategies for achieving faster recoveries.

Understanding the Role of AI in Credit Collection

AI in credit collection refers to the use of machine learning algorithms, data analytics, and automation to manage and optimize the debt recovery process. Instead of relying on outdated spreadsheets or one-size-fits-all strategies, AI tools analyze debtor behavior, payment history, and communication preferences to guide more effective collection efforts.

Benefits of AI-Powered Debt Recovery

AI-driven solutions offer several advantages that directly contribute to faster and more successful recoveries:

Predictive Analytics

AI can forecast which accounts are most likely to pay, allowing agents to prioritize high-probability cases.

Personalized Communication

Machine learning algorithms tailor messaging based on the debtor's behavior and preferences, improving response rates.

Automated Workflows

AI automates repetitive tasks such as follow-up reminders, emails, and payment notifications, reducing manual effort.

Real-Time Monitoring

Collectors can track payment progress, identify delays, and adjust strategies in real time.

Compliance Assurance

AI ensures that communication and recovery strategies align with regulatory frameworks and compliance standards.

Smarter Strategies Enabled by AI

AI technology doesn’t just speed up the process—it makes it smarter. Here are some top AI-enhanced strategies for better collection results:

Segmenting Debtors Intelligently

Group customers by risk level, payment behavior, and account age for targeted collection tactics.

Optimizing Contact Timing

AI tools determine the best times and channels (SMS, email, call) to reach each debtor.

Offering Dynamic Payment Plans

Based on debtor profiles, AI recommends flexible payment solutions to increase recovery likelihood.

Reducing Agent Workload

AI chatbots and self-service portals handle routine queries, freeing up agents for high-value tasks.

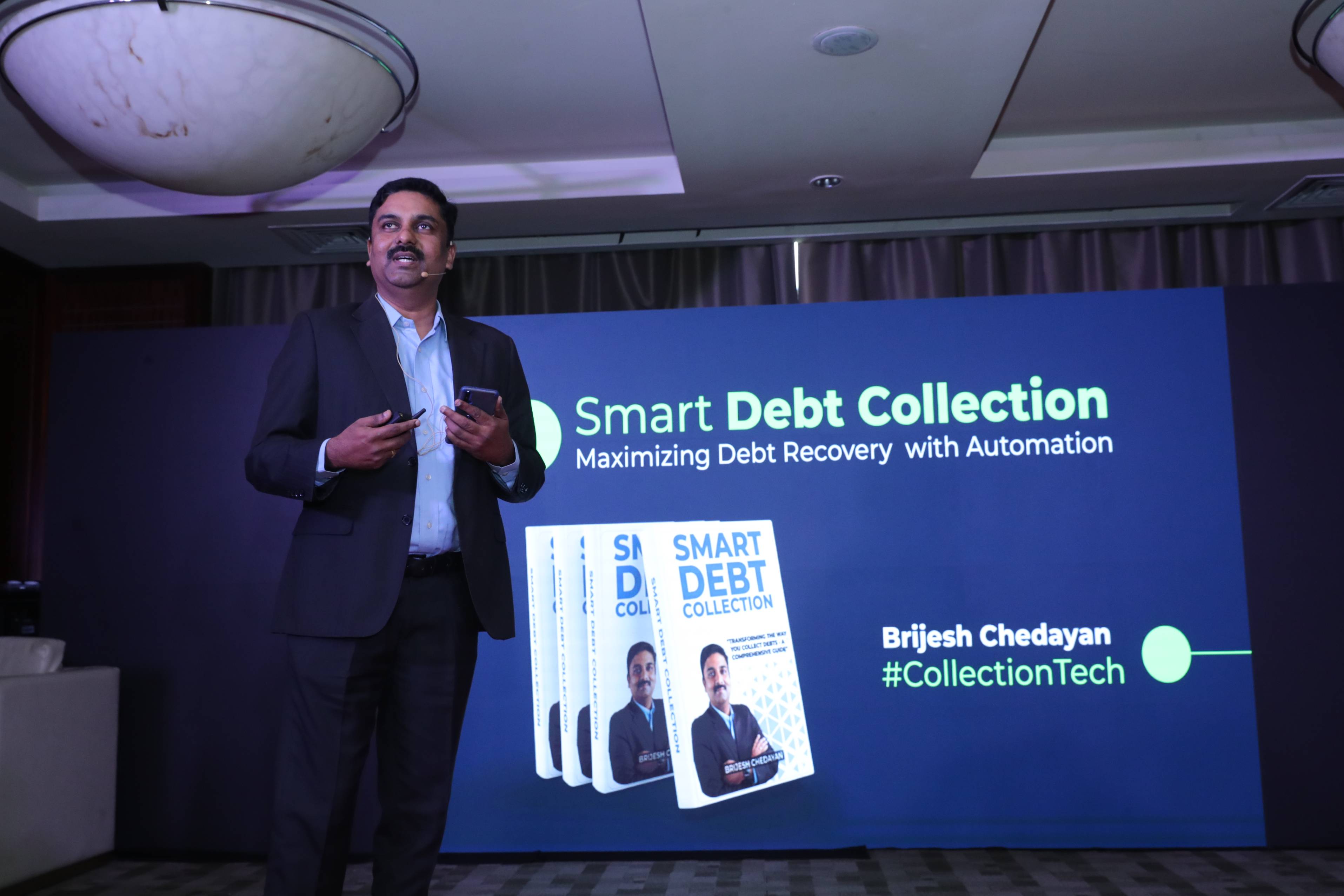

For Credit Collectors in Egypt: Why Choose Smart Debt Collection Software

Credit recovery professionals in Egypt need modern tools that align with local market dynamics, legal frameworks, and operational efficiency goals. Smart Debt Collection Software by Beveron is the ideal solution for forward-thinking collection agencies and in-house finance teams.

Here’s why it stands out:

- AI-powered automation for faster recoveries

- Smart debtor profiling and personalized communication tools

- Seamless integration with email, SMS, and payment gateways

- Real-time dashboards and analytics for performance tracking

- Full compliance with Egyptian regulatory standards

Whether you're managing thousands of accounts or focusing on high-risk portfolios, Smart Debt Collection simplifies the entire recovery process with intelligent automation.

Ready to Recover Smarter and Faster?

Join leading credit professionals in Egypt who are transforming their recovery operations with Smart Debt Collection Software. Say goodbye to delays and manual follow-ups—embrace an AI-driven solution designed for efficiency and results.

Explore Smart Debt Collection today and unlock faster, smarter, and more compliant debt recovery.

Best credit collection software in Egypt

Best debt management software in Egypt

Best debt recovery software in Egypt

If you need free demo on best credit collection software in Egypt, please fill the form below.