Top Benefits of Using Credit Collection Software for SMEs

Top Benefits of Using Credit Collection Software for SMEs

Managing outstanding debts is a challenge that many small and medium-sized enterprises (SMEs) face daily. Whether it’s late payments from clients or overdue invoices, uncollected debts can have a significant impact on cash flow and business growth. Fortunately, the right credit collection software can transform this process, offering both operational efficiency and financial stability.

In this article, we’ll explore the top benefits of using credit collection software for SMEs, highlighting how it can streamline collections, reduce administrative workload, and improve overall financial health.

Streamlined Debt Collection Process

One of the primary advantages of using credit collection software is its ability to automate and streamline the debt collection process. The software can handle tasks such as:

- Automated reminders: Send payment reminders to clients without manual intervention.

- Payment tracking: Keep track of overdue payments and manage follow-ups efficiently.

- Custom workflows: Set up automated workflows based on payment due dates, client history, and priority.

By automating routine tasks, SMEs can focus more on business growth and less on administrative chores.

Improved Cash Flow Management

For any business, maintaining healthy cash flow is vital. Late payments can quickly lead to financial strain, but with credit collection software, SMEs can:

- Reduce collection times: Set up automated reminders to prompt clients to pay before invoices become overdue.

- Improve recovery rates: Collect outstanding payments faster by effectively managing reminders and follow-ups.

- Track multiple accounts: Monitor several debtors at once, ensuring no payment is overlooked.

This efficient system of monitoring accounts and payments helps SMEs keep cash flowing and prevent payment bottlenecks.

Enhanced Customer Relationship Management

Though credit collection is essential, maintaining good client relationships is equally important. Credit collection software can enhance communication by:

- Personalized communication: Send tailored reminders based on the client’s payment history and communication preferences.

- Transparency: Offer clients access to their own accounts to view their outstanding payments, reducing confusion and potential disputes.

- Friendly reminders: Automated reminders can be polite and non-confrontational, preserving the relationship with clients.

Building a reputation for being organized and fair can help businesses maintain their clientele while managing collections effectively.

Compliance and Risk Management

Staying compliant with financial regulations is critical for any business. Credit collection software can help SMEs avoid potential risks by:

- Tracking compliance: Ensure that all communication and actions adhere to industry regulations.

- Secure data management: Safeguard sensitive client data through encrypted and secure systems.

- Audit trails: Maintain clear records of all transactions and communication for future audits or legal purposes.

This reduces the risk of legal issues and helps businesses stay on the right side of financial regulations.

Scalable and Cost-Effective

For SMEs, every dollar spent matters. Credit collection software is often scalable, allowing businesses to grow without significant additional costs. Key benefits include:

- Affordable subscription models: Choose from various pricing models based on the size of the business.

- Scalability: The software grows with your business, adapting to increased debtors and transactions.

- Reduced overhead: Minimize the need for additional staff by automating the collections process.

This makes credit collection software a highly cost-effective investment for growing SMEs.

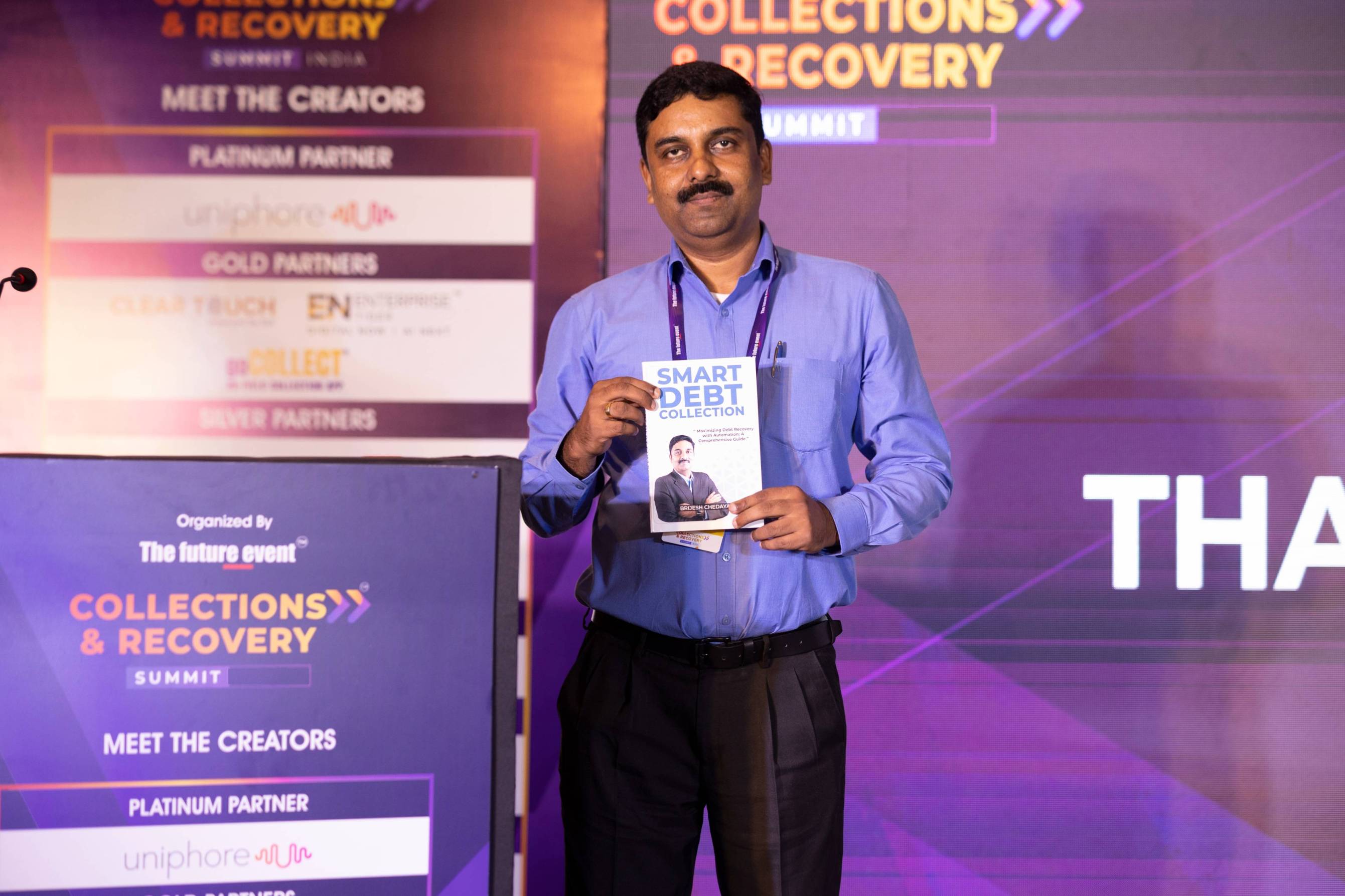

Debt Collection in Tanzania: The Smart Solution

For businesses in Tanzania, adopting an advanced debt collection solution is key to boosting financial efficiency. Beveron’s Smart Debt Collection offers a cloud-based platform designed to handle debt management for SMEs with ease. With automated reminders, payment tracking, and compliance features, Smart Debt Collection allows Tanzanian businesses to recover outstanding debts quickly and efficiently.

Take Action Now: Explore Smart Debt Collection

Don’t let overdue payments hinder your business growth. With Smart Debt Collection by Beveron, your SME can streamline credit collection, enhance cash flow, and maintain positive client relationships.

Explore Smart Debt Collection today and unlock a more efficient, secure, and scalable way to manage your debt recovery process.

Best credit collection software in Tanzania

Best debt recovery software in Tanzania

Best debt collection software in Tanzania

If you need free demo on best credit collection software in Tanzania, please fill the form below.