Increase Cash Flow with Real-Time Payment Tracking & Reminders

Increase Cash Flow with Real-Time Payment Tracking & Reminders

Cash flow is the lifeblood of any business. Without consistent inflow, even profitable companies can face operational slowdowns, missed opportunities, or financial instability. For businesses that rely on timely payments—such as lenders, service providers, or collection agencies—real-time payment tracking and automated reminders can make all the difference.

Why Real-Time Payment Tracking Matters

Manual payment tracking is time-consuming, error-prone, and often leads to late follow-ups or overlooked dues. Real-time payment tracking ensures:

- Instant updates on payments received or missed

- Better visibility of outstanding balances

- Quick identification of late-paying clients

- Faster response time for follow-ups or escalations

With full transparency into who has paid and who hasn’t, your team can act decisively to maintain consistent cash flow.

Benefits of Automated Payment Reminders

Automated reminders reduce the burden of manually chasing payments and increase the likelihood of on-time collections. Benefits include:

- Reduced late payments: Timely notifications remind clients before and after due dates

- Professional communication: Messages are sent with consistent tone and branding

- Improved customer relationships: Friendly reminders help clients avoid missed payments

- Increased team efficiency: Staff spends less time on repetitive follow-ups

You can set reminders to trigger based on invoice due dates, payment schedules, or past behaviors—ensuring a personalized yet automated approach.

Key Features to Look for in a Payment Tracking & Reminder System

When selecting a platform to automate payment tracking and reminders, ensure it offers:

- Real-time dashboard for payment status and overdue accounts

- Customizable reminder schedules (pre-due, post-due, follow-up)

- Multi-channel communication (email, SMS, WhatsApp)

- Integration with accounting systems for seamless updates

- Reporting and analytics to identify trends and problem accounts

These features not only help improve current collections but also allow you to forecast and plan more accurately.

The Cash Flow Impact: Faster Recovery, Stronger Growth

Implementing real-time payment tracking and automated reminders can lead to:

- Shorter payment cycles

- Increased recovery rates

- Improved financial forecasting

- Stronger liquidity and reinvestment capacity

By staying ahead of delinquencies and ensuring consistent follow-ups, businesses create a more predictable and stable cash flow environment.

For Debt Collectors in Algeria: The Smarter Way to Collect

In Algeria, debt collectors face increasing challenges—from rising volumes to strict compliance demands. Manual tracking and inconsistent communication can quickly lead to missed recoveries and reputational risks.

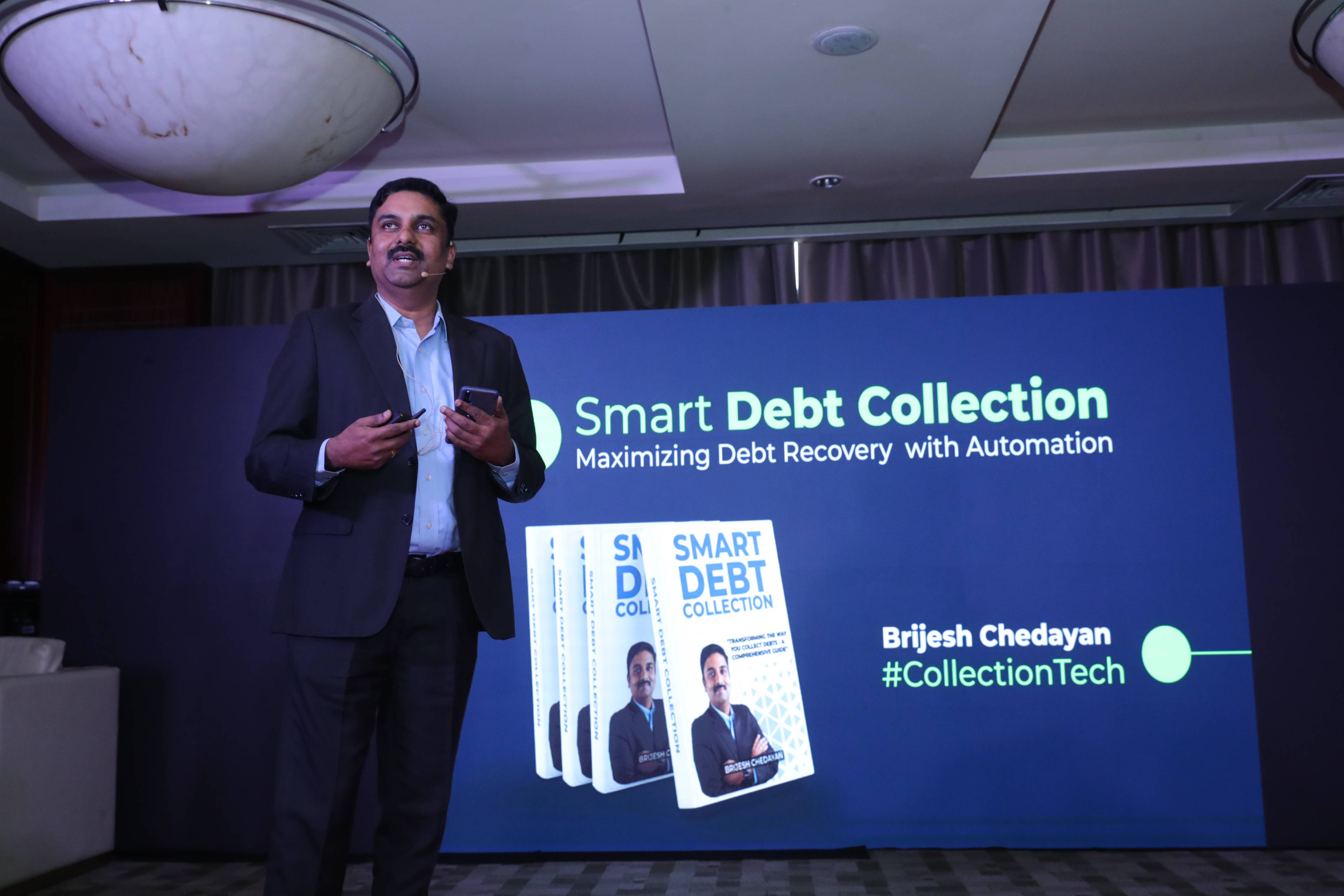

That’s where Smart Debt Collection Software by Beveron steps in as the leading solution.

Tailored for collection agencies and financial teams in Algeria, Smart Debt Collection Software offers:

- Real-time payment tracking dashboards

- Automated multi-lingual reminders via email, SMS, and WhatsApp

- Secure data management and compliance-friendly operations

- Arabic and French support for seamless integration

Take Control of Your Collections

If you’re ready to boost your cash flow and recover payments faster, it’s time to switch to a smarter solution.

Visit www.beveron.com to learn more or book a free demo of Smart Debt Collection Software today.

Stay ahead of defaults. Automate your collections. Power your growth with Smart Debt Collection.

Best payment collection software in Algeria

Best credit collection software in Algeria

Best software for debt recovery in Algeria

If you need free demo on best payment collection software in Algeria, please fill the form below.