Cloud-Based CRM vs. On-Premise: What’s Best for Collection Agencies?

Making the Right Technology Choice for Modern Debt Recovery

In an industry where speed, accuracy, and compliance are non-negotiable, debt collection agencies must rely on technology that supports agility and efficiency. Customer Relationship Management (CRM) systems are central to this — but choosing between a cloud-based or on-premise solution can make a significant difference in operational success.

With the digital landscape evolving, many agencies are re-evaluating traditional systems in favor of scalable, accessible alternatives. Here's a breakdown of both options and what’s best suited for today’s collection challenges.

Understanding On-Premise CRM

On-premise CRM systems are installed locally on a company’s own servers. While this setup offers full control, it often comes with high upfront costs and ongoing maintenance requirements.

Pros:

- Complete control over data and infrastructure

- Customizable to unique internal IT configurations

- No reliance on third-party hosting

Cons:

- High initial capital expenditure

- Requires dedicated IT staff and resources

- Limited scalability and remote accessibility

Advantages of Cloud-Based CRM

Cloud-based CRMs are hosted online, offering access from anywhere with an internet connection. These solutions are growing in popularity due to their flexibility and cost-effectiveness.

Key benefits:

- Remote access: Teams can work from anywhere, ideal for distributed agents

- Lower upfront costs: Subscription-based pricing with minimal infrastructure investment

- Automatic updates and backups: Ensures system security and functionality without manual intervention

- Scalability: Easily adapt to growing portfolios and team sizes

- Faster deployment: No complex installation needed

What Matters Most for Collection Agencies?

Debt collection requires timely communication, secure data handling, and real-time reporting. A modern CRM must support the following:

- Multi-channel communication (email, SMS, calls)

- Real-time payment tracking and reminders

- Compliance tools for data privacy and regulatory requirements

- Agent productivity tracking

- Integration with accounting and payment gateways

Cloud-based CRMs offer these features without the burden of managing infrastructure, making them ideal for fast-moving agencies.

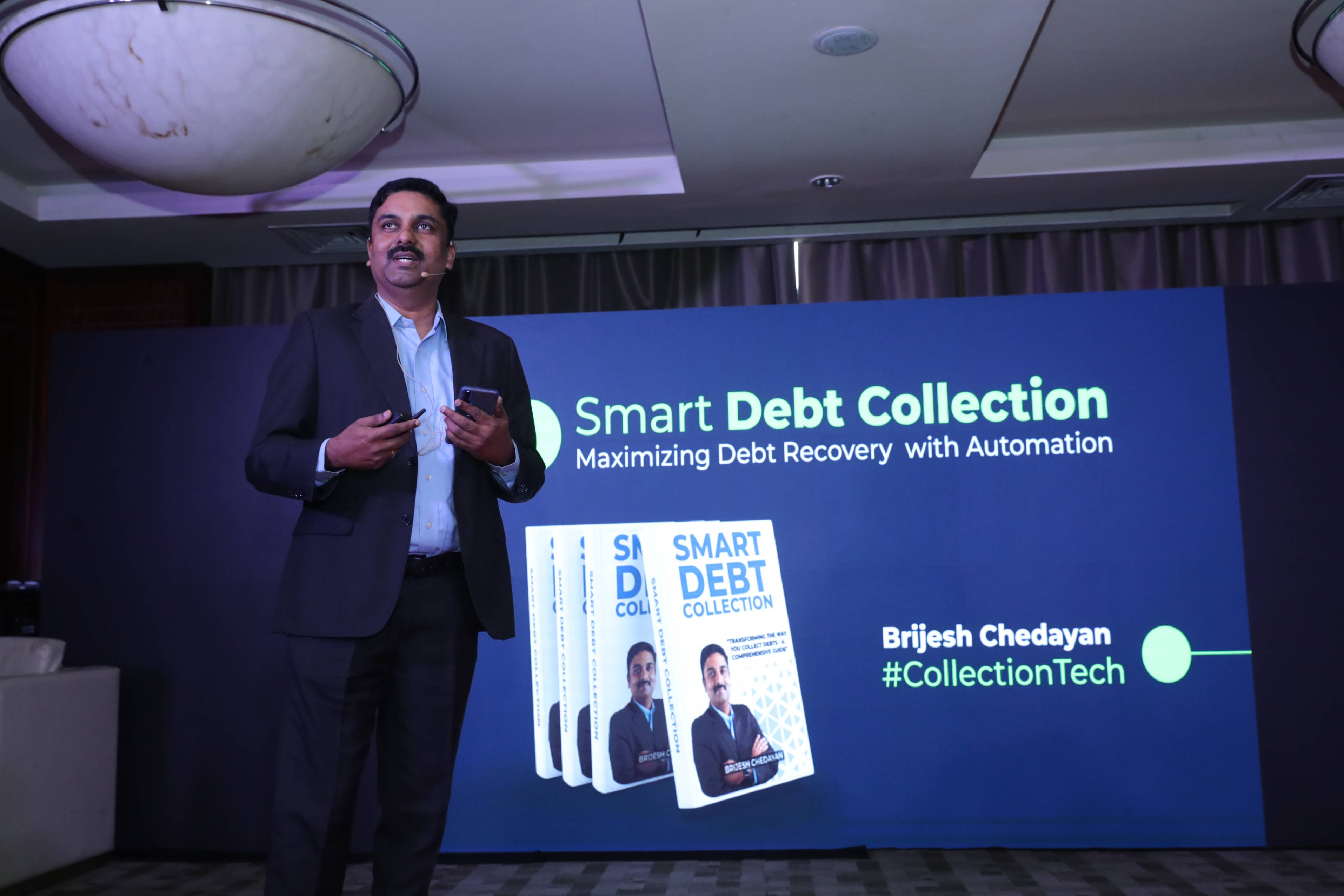

Why Indian Agencies Choose Smart Debt Collection by Beveron

For collection agencies in India, Beveron’s Smart Debt Collection software offers the ideal cloud-based solution. Tailored specifically for the debt recovery industry, it helps agencies improve recovery rates, ensure compliance, and scale operations efficiently.

Why Smart Debt Collection is the right fit:

- 100% cloud-based platform designed for Indian market dynamics

- Built-in tools for agent tracking, communication, and automated follow-ups

- GST and local regulation compliance

- Secure, scalable, and easy to deploy

Upgrade to a Smarter Collection System Today

The future of debt collection is cloud-powered. Discover how Beveron’s Smart Debt Collection CRM can streamline your recovery processes and drive better results.

Book a free demo or speak with a product expert to get started today.

Best collection agency CRM software in India

Best credit collection software in India

Best debt recovery management software in India

If you need free demo on best collection agency CRM software in India, please fill the form below.